Effective Forex Trading Strategies for Small Investors

Forex trading can be a lucrative venture, but for small investors, the stakes can often feel higher due to limited capital. Fortunately, there are several strategies that can help these traders navigate the volatile forex landscape effectively. For a deeper insight into trading options, visit forex trading strategies for small accounts Trading Brokers in India. In this article, we will explore various strategies, risk management techniques, and essential tips for small forex traders. By adopting the right approach, even small accounts can achieve impressive results in the forex market.

Understanding the Forex Market

The foreign exchange market, commonly known as forex, is the largest financial market in the world. With a daily trading volume exceeding $6 trillion, it offers ample opportunities for profit. However, this market is also known for its volatility, which can lead to significant losses if not managed properly. For small investors, understanding the fundamental and technical aspects of forex trading is critical for success.

Key Strategies for Small Traders

1. Scalping

Scalping is a short-term trading strategy that involves making numerous trades throughout the day to capture small price movements. This strategy can be beneficial for small investors as it requires minimal capital and focuses on quick profits. Traders utilizing scalping must be highly disciplined and have access to real-time data to make informed decisions rapidly.

2. Swing Trading

Swing trading involves holding positions for a few days to capitalize on expected market swings. This strategy is less time-consuming than day trading and can be ideal for small traders who may not have the luxury to monitor the market throughout the day. By analyzing market trends and identifying critical support and resistance levels, traders can position themselves to take advantage of short to medium-term price movements.

3. Position Trading

Position trading is a long-term approach where traders hold their investments for weeks, months, or even years. This strategy requires significant market analysis and a solid understanding of macroeconomic factors influencing currency values. While it offers smaller frequent opportunities compared to scalping or swing trading, it can yield substantial returns over time with less stress associated with day-to-day market fluctuations.

Risk Management Strategies

Effective risk management is crucial for small investors to protect their capital and ensure long-term success. Here are some key risk management strategies:

1. Use Stop-Loss Orders

Stop-loss orders are essential tools for managing risk. By setting a predetermined price at which to close a losing position, traders can significantly limit their losses and protect their trading capital. It’s advisable to determine a stop-loss point based on technical analysis, as this can help improve the decision-making process when market conditions change.

2. Diversify Your Portfolio

Diversification is a powerful risk management strategy that involves spreading investments across different currencies or trading instruments. This approach helps to minimize the impact of a poor-performing trade on the overall portfolio. Small investors should consider diversifying their trades across different currency pairs to mitigate risks associated with currency fluctuations.

3. Control Position Sizing

Position sizing refers to determining how much capital to risk on a trade. Small traders should avoid risking more than 1-2% of their trading capital on a single trade. By adhering to this principle, traders can prevent significant losses and ensure they can continue trading over the long term.

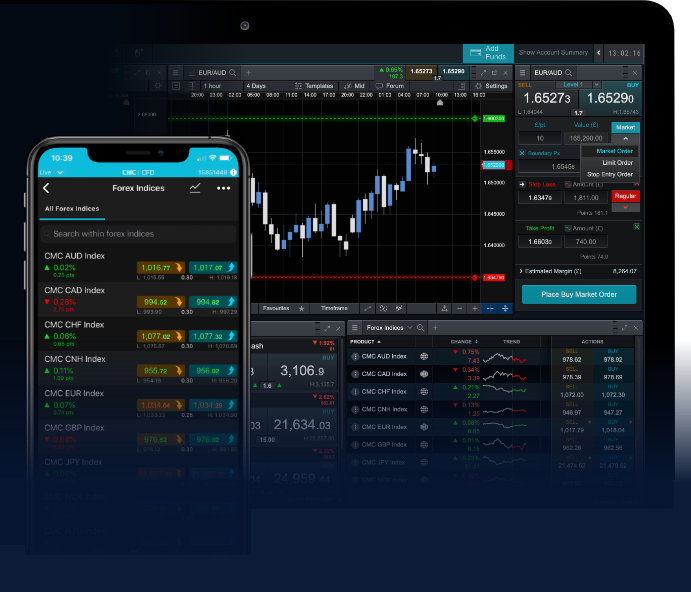

Choosing the Right Trading Platform and Tools

For small investors, choosing the right trading platform is vital. A good trading platform should offer user-friendly features, reliable execution, and access to analytical tools. Additionally, consider brokers that provide educational resources specifically tailored for beginner traders. Leverage tools such as demo accounts to practice strategies without risking real money, which is particularly valuable for small investors seeking to build their trading skills.

Continuous Learning and Adaptation

The forex market is dynamic and ever-evolving. As a small investor, continuous learning and adaptation are essential to remain competitive. Regularly analyze your trades, learn from both successes and failures, and stay updated on geopolitical events that can influence currency prices. Engaging with trading communities, reading relevant literature, and following market analysts can greatly enhance your trading knowledge and decision-making process.

Conclusion

Forex trading offers significant opportunities for small investors willing to invest time and effort into understanding the market. By adopting well-thought-out strategies such as scalping, swing trading, and position trading, and by implementing robust risk management practices, traders can navigate this challenging environment effectively. Continuous learning and the right tools can further enhance trading capabilities, making the forex market an accessible avenue for small investors seeking to grow their capital.