The World of Forex Trading Business: Opportunities and Strategies

Forex trading has become a significant business sector around the globe, offering unique opportunities for investors and individuals willing to dive into the financial markets. With the advent of technology, trading has transitioned from traditional exchanges to online platforms, making access to the Forex market easier than ever. For instance, many forex trading business Indian Trading Platforms serve as vital resources for traders seeking to navigate foreign exchange markets efficiently. In this article, we will explore the essentials for succeeding in the Forex trading business, including strategies, risks, and the essential tools required.

Understanding Forex Trading

The foreign exchange (Forex) market is the largest and most liquid financial market in the world. It operates 24 hours a day, five days a week, and allows individuals and institutions to buy, sell, exchange, and speculate on currencies. The primary participants in the Forex market include banks, financial institutions, corporations, and retail traders. With trillions of dollars traded daily, the Forex market exhibits high volatility, offering prospects for profit and, unfortunately, increased risk.

Getting Started with Forex Trading

Entering the Forex market requires a comprehensive understanding of its mechanics. Here are some key steps for starting your Forex trading journey:

- Choosing a Trading Account: You will need to select a reliable broker and open a trading account. Brokers offer various account types, each with different margin requirements, leverage options, and fees.

- Understanding Currency Pairs: Traders don’t trade currencies in isolation; instead, currencies are quoted in pairs (e.g., EUR/USD, GBP/JPY). Understanding how these pairs interact is crucial for successful trading.

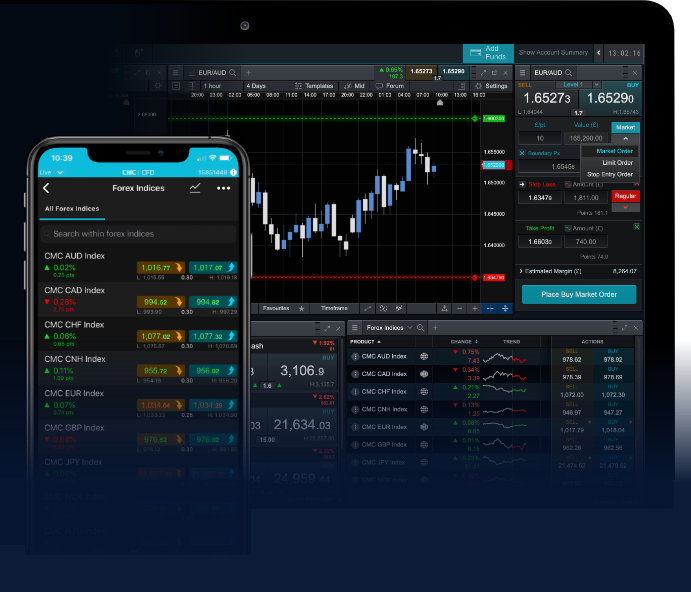

- Utilizing Trading Platforms: Modern trading platforms provide traders with access to essential tools and features, such as charts, indicators, and the ability to execute trades in real time. Familiarize yourself with the software you choose to use.

Trading Strategies

Successful Forex trading isn’t just about luck; it requires the application of various strategies based on market analysis. Here are several commonly employed strategies:

- Scalping: This involves making numerous trades over a short time frame to capitalize on small price movements. Scalpers hold positions for seconds or minutes and often make dozens of trades in one session.

- Day Trading: Day traders open and close positions within the same trading day. They aim to profit from short-term price movements, avoiding overnight risks.

- Swing Trading: Swing traders look to capture price movement over several days to weeks. They analyze trends and price patterns, holding trades for longer periods compared to day traders.

- Position Trading: This long-term strategy relies on fundamental analysis. Position traders hold trades for months or even years, ignoring short-term market fluctuations.

Risk Management

In the Forex trading business, risk management is paramount. Without proper risk management, even the most experienced traders can incur significant losses. Here are several key strategies to manage risk:

- Setting Stop-Loss Orders: A stop-loss order automatically closes your position when it reaches a certain level, preventing further losses.

- Position Sizing: Determine the size of your trading positions based on your overall account size and risk tolerance. Never risk more than a small percentage of your trading capital on a single trade.

- Diversifying Your Portfolio: Instead of placing all your funds in one currency pair, diversify your investments across various pairs and assets to minimize risk exposure.

The Importance of Education and Analysis

Knowledge is power in the Forex market. Continuous education through online courses, webinars, and trading forums can help enhance your trading skills. Additionally, utilizing technical analysis and fundamental analysis aids traders in making informed decisions.

Technical analysis involves studying price charts and indicators, identifying trends, and determining entry and exit points. Conversely, fundamental analysis focuses on economic indicators, news events, and geopolitical factors that could impact currency values.

The Role of Trading Psychology

Trading psychology is an essential component of long-term trading success. Managing emotions, such as fear and greed, is crucial for making unbiased trading decisions. Traders must remain disciplined, adhering to their trading plans without deviating based on emotional reactions to market fluctuations.

Choosing the Right Broker

Finding a trustworthy broker is critical for any trader. Consider factors such as regulatory compliance, trading fees, customer service, and the availability of trading tools. Reviews and ratings can provide insights into the experiences of other traders, guiding your choice.

Conclusion

In conclusion, the Forex trading business presents unique opportunities for those willing to invest time and effort into understanding the market. By educating yourself on trading strategies, risk management, and maintaining a disciplined approach, you can navigate the complexities of Forex trading successfully. As you embark on this financial journey, remember the importance of choosing robust trading platforms and staying informed about market developments. With dedication and informed decision-making, the Forex market can become a lucrative business avenue.