The Rise of Robot Trading in Forex: Automating Your Success

In the rapidly evolving world of financial markets, automation has taken center stage, particularly in the forex trading domain. With the advent of algorithms and artificial intelligence, traders now have the ability to employ robots for trading purposes. This innovative approach not only streamlines the trading process but also enhances efficiency and precision. As more traders turn to automated solutions, understanding the fundamentals of robot trading becomes essential. This overview will guide you through what robot trading in forex entails, its benefits, and how to get started. For those seeking reliable platforms to facilitate their trading journeys, consider exploring robot trading forex FX Trading Broker.

What is Robot Trading?

Robot trading, also known as algorithmic trading or automated trading, refers to the use of computer programs that follow a predefined set of instructions to execute trading decisions. These trading robots can analyze market data, execute trades, and manage account portfolios without human intervention. They leverage mathematical models and strategies to capitalize on market movements, allowing traders to profit from small fluctuations in currency prices, which are characteristic of the forex market.

How Does Robot Trading Work?

At its core, robot trading operates based on algorithms, which are sequences of instructions designed to perform specific tasks. These algorithms can analyze vast amounts of market data at lightning speed, identify trading opportunities, and execute trades efficiently. Traders can customize these algorithms according to their individual strategies, risk tolerance, and market conditions.

The process typically involves several steps:

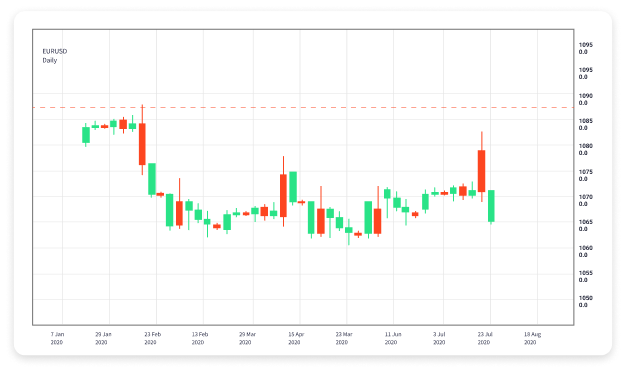

- Market Analysis: The robot continuously scans the forex market for various indicators, including price movements and chart patterns.

- Signal Generation: Based on the analysis, the robot generates buy or sell signals based on predetermined criteria.

- Execution: Once a signal is generated, the robot executes the trade automatically, often within milliseconds.

- Monitoring and Adjustments: The robot continuously monitors its trades and makes adjustments as necessary to protect the trader’s investment and maximize profit.

Benefits of Robot Trading in Forex

There are several advantages associated with the use of trading robots in the forex market:

- Emotionless Trading: One of the primary benefits of robot trading is that it removes emotional bias from trading decisions. Human traders may experience fear, greed, or uncertainty, leading to poor decision-making. Robots, on the other hand, stick to their programming, executing trades based on logic and analysis.

- Increased Efficiency: Robots can analyze data and execute trades far more quickly than a human can. This ability can be particularly beneficial in fast-moving markets where every second counts.

- 24/7 Operation: The forex market operates 24 hours a day, and robots can take advantage of this continuous trading environment. While human traders need to rest, robots can monitor and trade even while the trader sleeps.

- Consistent Trading Strategy: Trading robots operate on clearly defined rules and strategies. This consistency can lead to improved trading results, especially when dealing with complex strategies that may be difficult for a human trader to manage.

- Backtesting: Many trading robots offer the ability to backtest strategies using historical data. This feature allows traders to refine their strategies before deploying them in live markets.

Challenges and Considerations

While there are many benefits to robot trading, it’s important to be aware of the potential challenges and considerations:

- Market Conditions: Robots are programmed based on historical data and may not adapt well to sudden changes in market conditions. Unexpected volatility can lead to significant losses.

- Technical Failures: Trading robots rely on technology and can be vulnerable to glitches, server issues, or connectivity problems that may hinder performance.

- Over-Optimization: Traders may overly optimize their robots for past performance, which can lead to poor results in future trading due to overfitting.

- Dependence on Technology: Relying solely on robots can make traders complacent and reduce their understanding of market dynamics and trading fundamentals.

- Costs: Some trading robots come with high fees or subscription costs. Assessing the return on investment is crucial before committing to any automated trading solution.

How to Get Started with Robot Trading

If you are interested in incorporating robot trading into your forex strategy, here are some steps to consider:

- Choose a Reliable Broker: Selecting the right broker is critical. Look for one that offers robust trading platforms and supports algorithmic trading. Ensure they provide a demo account for practice.

- Understand Your Strategy: Before implementing a robot, have a clear understanding of your trading strategy, risk tolerance, and market objectives.

- Test a Demo Account: Many brokers offer demo accounts where you can test the robot’s performance without risking real money. Use this opportunity to familiarize yourself with its algorithms and strategies.

- Monitor Performance: Continuously monitor the performance of your robot even after deploying it in live markets. Regular assessments will help identify areas for improvement.

- Stay Informed: Keep yourself updated on market trends and technological advancements in the field of automated trading. Understanding market dynamics is essential even when using robots.

Conclusion

Robot trading is revolutionizing the forex market, providing traders with an opportunity to automate their strategies and potentially enhance their trading performance. While the benefits are significant, it’s essential to approach automated trading with a clear understanding of its challenges and limitations. By selecting the right tools and maintaining a balanced approach, traders can successfully blend the precision of technology with their market knowledge, paving the way for informed and efficient trading in the forex market.